ABM Foundations — What It Is, Why It Matters, and When to Use It

A strategic primer for SaaS founders and revenue leaders

ABM ≠ Lead Gen

Traditional demand‑gen treats every inbound lead as a potential buyer; Account‑Based Marketing (ABM) starts with a named set of companies and orchestrates every message, channel, and touch‑point around winning them. The result is a “fit → intent → engagement” funnel instead of the old “awareness → MQL → SQL” conveyor belt.

Why this matters: In the 2023 Momentum ITSMA global benchmark, 71 % of ABM programs reported higher ROI than any other marketing investment in their company abmleadershipalliance.com.

When ABM Outperforms Inbound

SituationWhy ABM WinsHigh‑ACV SaaS (>$25 k)Fewer deals, larger buying committees—personalisation pays off.Crowded categoriesYou control the narrative for the exact accounts that matter.Long sales cyclesCoordinated touches keep all stakeholders engaged.Land‑and‑expand motionABM extends from net‑new to cross‑sell/upsell with the same data spine.

WP Engine, for example, narrowed its focus to <200 agencies, used 1:1 ads + SDR plays, and lifted pipeline opportunities by 28 %

The Business Case in Numbers

86 % of B2B marketers say ABM improves win‑rates compared with other tactics nrich.io

High‑performing ABM programs grow revenue 72 % faster than peers that stay lead‑centric Momentum ITSMA

Terminus’ own ABM play generated a 733 % increase in pipeline during its scale phase growthstage.marketing

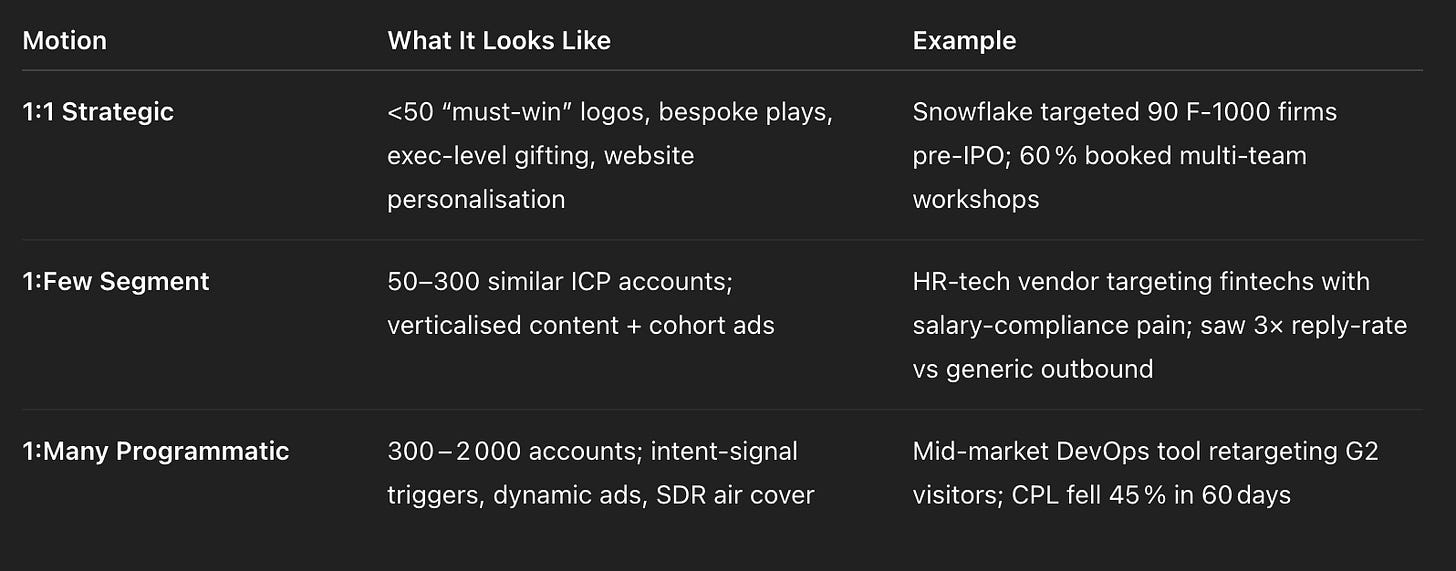

Three Proven ABM Motions

Critical Success Factors

Tight ICP definition — firmographic + technographic + behavioural

Joint ownership with Sales — weekly ABM stand‑ups, shared targets

Data spine — all intent, engagement, and product signals write back to the CRM/CDP

Personalised but scalable content — modular assets you can slot by vertical, pain, persona

Measurement on account level — coverage, engagement minutes, pipeline velocity; not raw lead count

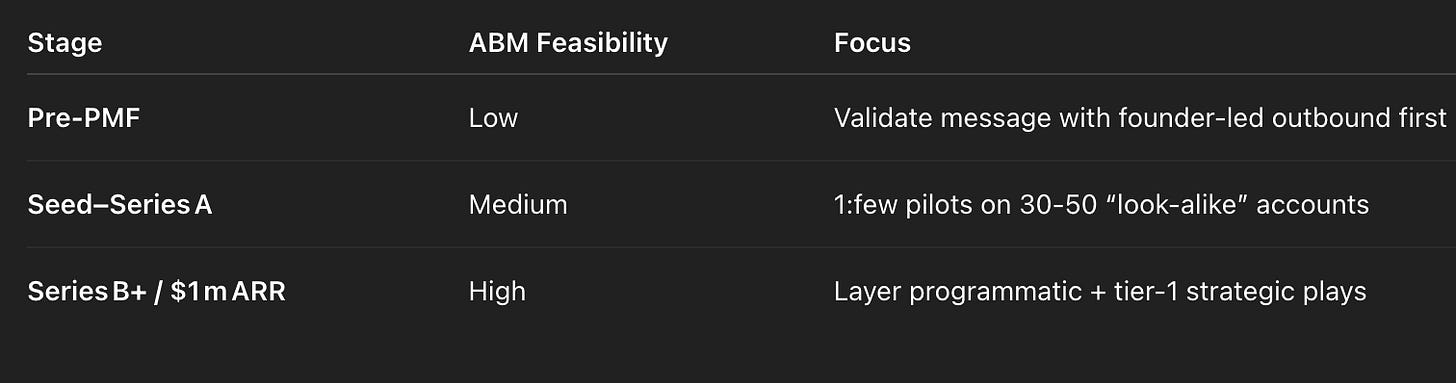

Early‑Stage Reality Check

Getting Started (Preview of Blog 2)

Mine CRM + product data to isolate your top‑retaining customers.

Enrich with firmographics/tech stack (Clearbit, Apollo).

Score for fit (industry, size) and growth potential (funding, hiring).

Create Tier‑1 (1:1), Tier‑2 (1:few), Tier‑3 (1:many) lists.

Align SDRs + marketers on quarterly objectives per tier.